Copyright 2023 Vivek Moorthy.© All Rights Reserved.

|

|

This website hosts the content of my books in the SCHEMATIC and related course outlines. Earlier, some of this content was displayed on my original website economicsperiscope.com, started about ten years ago, which is basically a strictly chronological list of my publications.Content from my book(s) and course material was being added as it evolved. However, the periscope website was becoming too dense in two ways. First, the book material at the top was becoming cumbersome. Second, I felt those readers interested only in the publications may find the book content to be an interference. Vice versa too: those interested in the course material would find the publications to be an interference. Although my publications and my book(s) are very closely connected and have evolved simultaneously, some time back I decided to move my course material here. Future relevant course material will be posted here. To comprehend the contents here, and as to why and how the

planned composite book on the left hand side, well over a decade ago

expanded into three mini books on the right, I request you to read this

Cunningham Constraint 2019 note. Full title: Coping with the

Colossal, Curricular Cunningham Constraint!

|

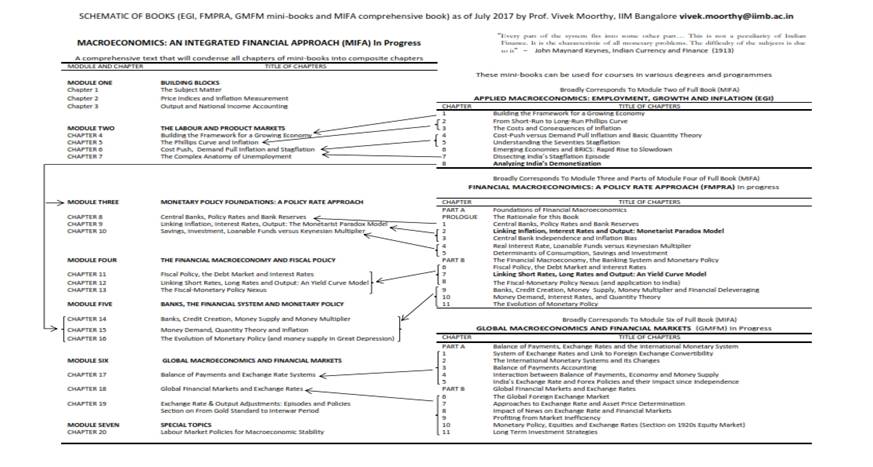

The SCHEMATIC of My Books (please print and peruse carefully)

|

The Chronology and Evolution of These Mini Books (as of February 2021) An earlier version of EGI was published in 2014 titled Understanding Stagflation: Past and Present as an e-book, with five chapters, by McGraw Hill Education (India). Due to inability to get some vital copyright permissions in time, the hard copy of that book had to be postponed. After obtaining those permissions much later, the expanded version comprising eight chapters, with the last Chapter on India's 2016 Demonetization, was brought out in 2017 as Applied Macroeconomics: Employment, Growth and Inflation (acronym EGI to be kept in mind). |

|

The TOC for the second mini book Financial Macroeconomics: A Policy Rate Approach (acronym PRA) is shown below. As of January 2021, my tentative plan is to merge these two into one book, but leaving out the last mini book on global macroeconomics. |

|

Ch.'ZERO' |

Preface and Table of Contents of Applied Macroeconomics (EGI) |

|

|

CH. 1 |

Building the Framework for a Growing

Economy |

Page

# |

|

1.1 |

1 |

|

|

1.2 |

Factors Affecting Aggregate Demand |

3 |

|

1.3 |

Factors Affecting Aggregate Supply |

5 |

|

1.3.1

Conventional

Approach to Growth for Developing Economies |

5 |

|

|

1.3.2

Solow

Growth Framework |

6 |

|

|

1.4 |

8 |

|

|

1.5 |

11 |

|

|

1.5.1

Links

between Output and Ease of Doing Business |

13 |

|

|

1.5.2

Other

Important Determinants of Growth |

19 |

|

|

1.6 |

21 |

|

|

1.7 |

Choosing the Right Output Measure for

Macroeconomic Analysis |

23 |

|

1.7.1

Fluctuations

around Potential GDP: A Hypothetical Case |

25 |

|

|

1.7.2

Classifying

Business Cycle Phases Theoretically |

26 |

|

|

1.8 |

Links between Unemployment Rate and

Output |

29 |

|

1.8.1

Okun's

Analysis and Okun's Law |

29 |

|

|

31 |

||

|

34 |

||

|

1.9 |

Estimates of Potential GDP and their

Limitations |

35 |

|

1.10 |

Classification of Actual Recessions |

37 |

|

Extra Q. |

#10 Estimating India's potential GDP as of data November 2021

|

45 |

|

CH. 2 |

From Short-Run to Long-Run Phillips

Curve |

|

|

2.1 |

Impact of Changing Aggregate Demand

on Unemployment |

48 |

|

2.2 |

The Original Phillips Curve |

49 |

|

2.3 |

The Phillips Curve Moves to America |

52 |

|

2.3.1 The Phillips Curve as a Policy

Choice |

53 |

|

|

2.4 |

The Friedman-Phelps Expectations

Augmented Phillips Curve |

54 |

|

2.4.1

Level

Versus Change Effects Upon Inflation |

56 |

|

|

2.5 |

Evidence for the Prediction of Rising

Inflation |

58 |

|

2.5.1 The Shifting Phillips Curve in

European Countries |

60 |

|

|

2.6 |

61 |

|

|

2.6.1

Inflation

and Growth in Developing Economies |

63 |

|

|

2.7 |

65 |

|

|

2.7.1

Policy

Decisions and EAPC Loops |

67 |

|

|

2.8 |

India's Inflation Targeting Debate |

67 |

|

CH. 3 |

The Costs and Consequences of

Inflation |

|

|

3.1 |

Categorizing the Costs |

71 |

|

3.2 |

Menu Costs |

72 |

|

3.2.1

Inflation

and the Frequency of Price Changes |

72 |

|

|

3.2.2 The Consequences of Staggered

Price Changes |

73 |

|

|

3.3 |

The Costs of Minting, Printing and

Counterfeiting |

74 |

|

3.4 |

How Inflation Distorts Price Signals |

76 |

|

3.5 |

78 |

|

|

3.6 |

79 |

|

|

3.7 |

The Convenience of Nominal Accounting |

80 |

|

3.8 |

Deflation Versus Disinflation |

82 |

|

3.9 |

The Sacrifice Ratio and Disinflation

Strategies |

83 |

|

3.9.1 The Volcker Disinflation |

84 |

|

|

3.9.2

Rational

Versus Adaptive Expectations and Credibility |

85 |

|

|

3.10 |

The EAPC/ADSGAP Model with Lags |

86 |

|

CH. 4 |

Cost Push Versus Demand Pull

Inflation and Quantity Theory |

|

|

4.1 |

The Cost-Push View |

91 |

|

4.2 |

92 |

|

|

4.3 |

Origins of the Natural Rate of

Unemployment Concept |

94 |

|

4.3.1 The Friedman-Solow Debate on

Wage-Price Guideposts |

94 |

|

|

4.3.2

Cost

Push and Wage Restraint in the Simple Phillips Curve |

95 |

|

|

4.3.3

Solow's

Defence and Friedman's Rejoinder |

96 |

|

|

4.4 |

98 |

|

|

4.5 |

Money Demand, Velocity and Quantity

Theory |

100 |

|

4.5.1

Income

and Velocity |

100 |

|

|

4.5.2 The Demand for Money |

102 |

|

|

4.5.3

Keynes'

Discussion of the Quantity Theory |

104 |

|

|

CH. 5 |

Understanding The

Seventies Stagflation |

|

|

5.1 |

The Huge Hike in Oil Prices |

109 |

|

5.2 |

111 |

|

|

5.3 |

113 |

|

|

5.4 |

Commodity Prices Versus the Cartel |

115 |

|

5.5 |

Response of US Fed Chairman Burns to

Stagflation |

116 |

|

5.6 |

Oil Prices and the World Economy: A

Brief Update |

119 |

|

CH. 6 |

Emerging Economies and BRICs: Rapid

Rise to Slowdown |

|

|

6.1 |

The Emergence of the Emerging Markets |

121 |

|

6.2 |

123 |

|

|

6.3 |

The Second BRICS Report: India in the

Fast Lane |

124 |

|

6.4 |

The Unexpected Slowdown |

126 |

|

6.5 |

The Closing of the Goldman Sachs

BRICS Fund |

130 |

|

6.6 |

Explaining the Rise and Fall of the

BRICS |

132 |

|

6.6.1 The Argentina Barings Crisis of

1890 |

132 |

|

|

6.6.2

Capital

Flow Reversals after 1990 |

133 |

|

|

6.7 |

Revisiting Japan's Prolonged

Stagnation |

136 |

|

6.7.1 A Different Financial and

Business System |

136 |

|

|

6.7.2

Role

of the Yen/Dollar Exchange Rate Agreement of 1987 |

137 |

|

|

6.7.3

Outlook

for China: Implications of Japan |

138 |

|

|

6.8 |

Geopolitical Importance of the BRICS |

140 |

|

142 |

||

|

6.9 |

Outlook for Emerging Economies and

their Equity Markets |

143 |

|

6.9.1

Returns

to Different Investors in the BRICS |

146 |

|

|

6.9.2 Volatility in MSCI China Versus

Shanghai Index |

149 |

|

|

150 |

||

|

6.10 |

Data Appendix |

152 |

|

CH. 7 |

Dissecting India's Stagflation

Episode |

|

|

7.1 |

156 |

|

|

7.1.1 The Widespread Nine Percent

Euphoria |

157 |

|

|

7.2 |

159 |

|

|

7.2.1

Real

Time Projections of Growth and Inflation |

161 |

|

|

7.3 |

NREGA, Labour Shortages and Wage

Increases |

163 |

|

7.4 |

166 |

|

|

7.5 |

A Protein Centric View of India's

Inflation |

168 |

|

7.5.1

Food

Prices and Inflation in Select Asian Countries |

169 |

|

|

7.6 |

The Food Inflation Episode in China |

170 |

|

7.6.1

Food

Inflation in a Two Sector Growing Economy |

171 |

|

|

7.7 |

Profits, Wages and Sales During

Stagflation |

172 |

|

7.8 |

173 |

|

|

7.9 |

GDP Measurement Issues and 2015

Revisions (Appendix) |

174 |

|

7.9.1

Evaluating

the 2015 GDP Revisions |

177 |

|

|

CH. 8 |

Analyzing India's Demonetization |

|

|

8.1 |

Basic Facts about the Note Ban |

182 |

|

8.1.1 The Various Stated Goals of the

Scheme |

184 |

|

|

8.2 |

Government Spending, Taxes and

Corruption |

185 |

|

8.2.1

Less

Spending versus More Taxes? |

186 |

|

|

8.2.2

Government

Spending, Cash Use and Election Funding |

187 |

|

|

8.2.3

India's

flawed Fiscal Responsibility Act? |

188 |

|

|

8.3 |

Basic Concepts for Evaluating the

Note Ban |

190 |

|

8.4 |

191 |

|

|

8.4.1

Complications

due to Counterfeiting |

192 |

|

|

8.5 |

Cash Use, Corruption, Taxes and

Digital Currencies |

194 |

|

8.5.1

Cash

Use and Corruption Across Countries |

194 |

|

|

8.5.2

Bitcoin,

Chinese Yuan and the US Dollar |

197 |

|

|

8.6 |

Projecting Impact of Note Ban |

198 |

|

8.6.1

Projections

based on Quantity Theory |

198 |

|

|

8.6.2

Printing

without Enough Planning |

199 |

|

|

8.6.3

Short

Term Impact beyond Quantity Theory |

200 |

|

|

8.7 |

Assessing Longer Term Impact |

201 |

|

8.7.1 A Simple Framework for Tax

Projections |

204 |

|

|

8.8 |

Varieties of Demonetization (Appendix

I) |

205 |

|

8.9 |

The Changing Promise on India's Rupee

Notes (Appendix II) |

207 |

|

8.9.1

China's

Slide away from Silver |

209 |

|

|

8.10 |

210 |

|

|

8.11 |

Tables

and Background Information (Table 8.E Chronology of Events) |

216 |

|

Financial Macroeconomics: A Policy

Rate Approach (FMPRA, unpublished) Chapter Numbers below correspond to those in MIFA book on lefthand of the Schematic. Chapters 13 and 14 are in draft form. Excerpts or full chapters below can be provided to individuals or publishers upon specific request |

|

|

Aug 2015 Prologue to Financial Macroeconomics: A Policy Rate Approach

|

Page # |

|

CH. 8 |

Central Banks, Policy Rates And

Bank Reserves |

|

|

PART A |

The Mechanics of Monetary Policy |

|

|

8.1 |

Various Interest Rates |

1 |

|

8.2 |

The Basics of Bond Pricing |

4 |

|

8.3 |

The Policy Rate and Open market Operations |

5 |

|

|

8.3.1 The Mechanics and Economics of Open Market

Operations |

8 |

|

|

8.3.2 A Description of Actual Open market

Operations |

11 |

|

8.4 |

The Policy Rates in India |

13 |

|

Part B |

Critiques of IS/LM |

|

|

8.B.1 |

Basic Critique: FAQ's on IS/LM |

15 |

|

8.B.2 |

Detailed Critique: Why IS/LM is Irrelevant and Wrong: An Explanation (To

class, Feb 2015) |

22 |

|

|

Data Appendix: LAF, MMS and Key RBI Interest

Rates and Ratios |

|

|

CH. 9 |

Linking Inflation, Interest Rates And Output: The Monetarist Paradox |

|

|

9.1 |

Introduction |

1 |

|

9.2 |

The Classical Theory of Interest |

2 |

|

9.3 |

Fisher Effect: Adding Inflation Expectations |

4 |

|

|

9.3.1 Behavioural versus Tautological Fisher

Equation |

5 |

|

9.4 |

The Policy Rate and the Keynesian Theory of

Interest |

6 |

|

9.5 |

10 |

|

|

9.6 |

Empirical Evidence from the Volcker Deflation |

14 |

|

9.7 |

Consequences of Pegging the Nominal Rate |

15 |

|

|

9.7.1 Can the Stance of Policy be Judged by

Interest Rates? (Advanced) |

16 |

|

9.8 |

The Monetarist Paradox with Nominal GDP Growth

Added |

19 |

|

9.9 |

India's Episode of Tail Chasing |

20 |

|

9.10 |

23 |

|

|

|

9.10.1 Evidence on the Fisher effect versus the Quantity Theory |

25 |

|

9.11 |

Origins of the Quantity Theory and Phillips Curve

|

30 |

|

|

End of Chapter Questions |

31 |

|

CH. 10 |

Central Bank Independence, Inflation Bias And The Monetarist Paradox |

|

|

10.1 |

The Political Business Cycle Based upon the EAPC |

1 |

|

10.2 |

Absence of Inflation Bias under the Gold Standard

|

3 |

|

10.3 |

The Political Business Cycle and Inflation Bias

in India |

4 |

|

10.4 |

Central Bank Independence to Control Inflation

Bias |

5 |

|

10.5 |

Cross Country Evidence on Inflation Bias and the Monetarist Paradox |

7 |

|

10.6 |

The Changing Independence of the Reserve Bank of

India |

9 |

|

10.7 |

Suitable Appointment Rules for Central Bank

Independence |

11 |

|

|

10.7.1 Suitable Appointment Rules for Central

Bank (Update Sept 2020) |

12 |

|

|

APPENDICES |

|

|

10.A |

Correspondence with Friedman about Blinder-Solow Proofs and Monetarist

Paradox |

14 |

|

10.B |

Summary of Critique (VM) of Blinder-Solow Proofs on Debt Stability |

16 |

|

10.C |

Origins of the Monetarist Paradox |

17 |

|

10.D |

Liquidity and the Economy (Excerpt from M.

Friedman's Money Mischief, a cartoon and a poem) |

18 |

|

CH. 11 |

The Loanable Funds Approach Versus Keynesian

Multiplier |

|

|

11.1 |

Introduction |

1 |

|

11.2 |

The classical/loanable funds theory in a private

closed economy |

2 |

|

11.3 |

Keynes' Approach to Savings, Investment

and the Rate of Interest |

4 |

|

11.4 |

The Keynesian Multiplier and the Paradox of

Thrift |

5 |

|

11.5 |

A Loanable Funds Critique of Keynes' Paradox of

Thrift |

7 |

|

|

11.5.1 Critique of the expanded IS/LM Model |

8 |

|

11.6 |

Relevance of Keynes' Approach in Some Situations

(Advanced) |

10 |

|

|

11.6.1 Limitations of full Multiplier Process

When Consumption Drops |

11 |

|

11.7 |

Short Run Keynesian Outcomes Within a Classical

Model (Advanced) |

12 |

|

|

11.7.1 Labour Supply and Keynes' Rejection of Loanable Funds Theory |

16 |

|

11.8 |

18 |

|

|

|

11.8.1 America's Recent Low Unemployment and Inflation: A Credit Based

Hypothesis |

20 |

|

|

APPENDICES |

|

|

11.A |

Supply and Demand for Loanable Funds: Dennis Robertson's

Categorization |

21 |

|

11.B |

The Non-Econometrician's Lament (Robertson's

poem) |

22 |

|

CH. 12 |

Consumption, Savings, Investment, And Interest

Rates |

|

|

12.1 |

The Two Main Components of GDP |

1 |

|

12.2 |

Determinants of Consumption: Alternative Theories

|

2 |

|

12.3 |

Components of Investment |

6 |

|

12.4 |

Growth Contributions of Components of GDP for

India 2009-10 |

8 |

|

12.5 |

9 |

|

|

12.6 |

Impact of Interest Rates: The Transmission

Mechanism of Monetary Policy |

14 |

|

12.7 |

Interest Rates and Bank Loan Officers Survey for

USA |

16 |

|

12.8 |

Savings data and Issues for India |

18 |

|

12.9.1 Article: Money and Currencies: High rates

hit home loans growth |

21 |

|

|

12.9.2 Article: SBI capex loan crash mirrors

investment strike at India Inc |

22 |

|

|

CH.13.A |

Fiscal Policy, Taxes, Deficits And

Debts (PART A) |

|

|

13.A.1 |

Fiscal policy in U.K. in the 19th century |

1 |

|

13.A.2 |

4 |

|

|

13.A.3 |

Trends in tax rates and taxes in USA |

4 |

|

13.A.4 |

Postwar US Fiscal Expansion |

5 |

|

13.A.5 |

The Financing of Government Spending |

6 |

|

13.A.6 |

Assessing the Economic Impact of Taxes |

7 |

|

13.A.7 |

The Full Employment Budget Deficit |

8 |

|

13.A.8 |

Components of U.S. Government Debt and Ownership

of US Treasury Securities Table |

12 |

|

13.A.9 |

Charts and Tables :

Fiscal Policy, Deficit and Debt |

13-19 |

|

13.A.10 |

Keynesian multiplier with taxes question |

20 |

|

CH.13.B |

Linking Short Rates, Long Rates & Output

(PART B) |

|

|

13B.1 |

Bringing in the Government Sector |

1 |

|

13B.2 |

Government Expenditure and Types of Crowding Out |

2 |

|

13B.3 |

Debt versus deficit as the Determinant of

Interest Rates |

4 |

|

13B.4 |

Interest rate Determination with Non-Tradable

Debt |

6 |

|

13B.5 |

The Vital Yield Curve GDP Nexus: Robust Evidence |

7 |

|

13B.6 |

A Loanable funds approach to the Yield Curve GDP

Nexus: Expanded Monetarist Paradox Model |

8 |

|

|

13.B.6.1 The Yield Curve During Postwar

Recessions and the Volcker Disinflation |

|

|

13B.7 |

Towards a more realistic Yield Curve based

Approach |

12 |

|

13.B.8 |

APPENDIX: Charts and Tables (Yield Curve, GDP,

Bond Yields, Debt Ratios, Leading Indicators) |

14-20 |

|

13.B.9 |

Yield Curve Model Sample Numerical Question |

21 |

|

CH. 14 |

Fiscal Issues In India

& Monetary Nexus |

|

|

14.1 |

Linkages between Fiscal and Monetary Policy (FISCMONSCHEMATIC) |

1 |

|

|

14.1.1 Important Fiscal variables and Definitions

|

2 |

|

14.2 |

Fiscal Accounts Concepts & Data |

3 |

|

14.2 |

Fiscal Accounts Concepts & Data |

3 |

|

14.3 |

Fiscal Concepts, Trends & Outlook |

4-11 |

|

14.4 |

Articles: Rewards of Profligacy (2000) & Don't Panic Over Delhi's

Deficit (2007) |

... |

|

14.5 |

Simulation Results of Debt-GDP Outcomes (DRG Study 2000 Sec 1.4) |

22-25 |

|

14.6 |

Debate with ex RBI Governor Economic Times Articles

below |

28-40 |

|

|

Part 1 Some Unpleasant Monetary Arithmetic/ Print

Bonds, Not Money |

|

|

|

Part 2 Should we Prefer Bonds or Money/ Why

Gentlemen Still Prefer Bonds (VM/1995) |

|

|

14.7 |

Small Savings Interest Rates and Taxes Article

& Table |

26-27 |

|

14.8 |

Summary Table: All Major Fiscal Ratios &

Interest Rates for India |

41 |

|

CH. 17 |

Postwar Evolution Of Monetary

Policy |

|

|

17.1 |

Introduction to Milton Friedman's Role of

Monetary Policy 1967 Speech |

1 |

|

17.2 |

What Monetary policy Can Do,

Cannot Do & How it Should be Conducted |

2 |

|

17.3 |

Evaluating Friedman's recommendations based on

1970s & 1980s |

5 |

|

|

TABLE: Monetary Policy Procedures Schematic |

6 |

|

17.4 |

Sir Alan's Day of Judgment (VM) Critique of Greenspan, January 2003 |

7 |

|

17.5 |

The Taylor Rule (St Louis Fed Summary & VM

handwritten note) |

11 |

|

17.6 |

The Fed Could Have Sold Long Bonds on the Greenspan Taylor 2009 debate, unpublished |

13 |

|

17.7 |

How (Direct) Inflation Targeting Evolved (VM

article) |

15 |

|

17.8 |

Current Federal Reserve Policy |

16 |